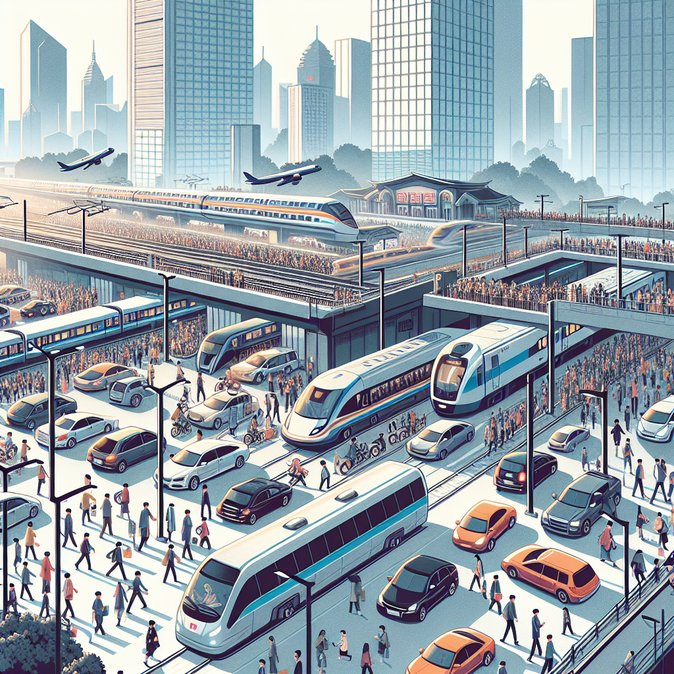

China’s annual 40-day Spring Festival travel rush, known as chunyun, officially starts on Monday and transport authorities predict an unprecedented 9.5 billion passenger journeys will take place before the period ends on 13 March. The record figure—almost one trip for every person on the planet—reflects pent-up demand for family reunions after years of pandemic disruption as well as a longer-than-usual nine-day public holiday that falls around 17 February.

Road traffic will again dominate: the Ministry of Transport expects private cars to account for roughly 80 percent of all inter-regional travel. To ease congestion, highway tolls for small passenger vehicles will be waived throughout the holiday and dynamic lane-reversal systems will be deployed on key expressways radiating from Beijing, Shenzhen and Shanghai.

China State Railway Group has added 426 daily trains and placed 120 new 350 km/h Fuxing high-speed sets in service, lifting national rail capacity to an estimated 540 million seats—7 percent higher than last year’s peak. Civil-aviation regulators have approved 2,100 extra domestic and regional flights, targeting popular migrant-worker corridors such as Shenzhen-Chongqing and Beijing-Harbin; total air passenger volume is forecast at 95 million.

![China Braces for Record-Breaking 9.5 Billion Trips as 2026 Spring Festival Travel Rush Begins]()

For travelers who may need to secure or adjust visas and other travel documents before braving the chunyun crowds, VisaHQ offers a streamlined, fully online solution. Through its China portal (https://www.visahq.com/china/), the service provides real-time guidance on entry requirements, application checklists, and courier submission options, helping corporate mobility managers and individual passengers obtain the necessary paperwork efficiently amid the holiday rush.

For global-mobility managers, the surge has practical implications. Corporations with assignees in China are being urged to avoid non-essential travel between 9 February and 25 February, when daily volumes will crest, and to reserve rail or air tickets as early as systems open (15 days in advance for rail; 30 days for air). Logistics firms have also warned that last-mile delivery times in lower-tier cities could double during the peak week.

The unusually strong demand is viewed by economists as an early sign of consumer-confidence recovery, with analysts at CICC estimating holiday spending on transport, hotels and attractions could inject RMB 120 billion (US $16.7 billion) of incremental consumption into the domestic economy. If realised, that would provide a welcome boost to service-sector growth as China enters the first year of its 15th Five-Year Plan.

Road traffic will again dominate: the Ministry of Transport expects private cars to account for roughly 80 percent of all inter-regional travel. To ease congestion, highway tolls for small passenger vehicles will be waived throughout the holiday and dynamic lane-reversal systems will be deployed on key expressways radiating from Beijing, Shenzhen and Shanghai.

China State Railway Group has added 426 daily trains and placed 120 new 350 km/h Fuxing high-speed sets in service, lifting national rail capacity to an estimated 540 million seats—7 percent higher than last year’s peak. Civil-aviation regulators have approved 2,100 extra domestic and regional flights, targeting popular migrant-worker corridors such as Shenzhen-Chongqing and Beijing-Harbin; total air passenger volume is forecast at 95 million.

For travelers who may need to secure or adjust visas and other travel documents before braving the chunyun crowds, VisaHQ offers a streamlined, fully online solution. Through its China portal (https://www.visahq.com/china/), the service provides real-time guidance on entry requirements, application checklists, and courier submission options, helping corporate mobility managers and individual passengers obtain the necessary paperwork efficiently amid the holiday rush.

For global-mobility managers, the surge has practical implications. Corporations with assignees in China are being urged to avoid non-essential travel between 9 February and 25 February, when daily volumes will crest, and to reserve rail or air tickets as early as systems open (15 days in advance for rail; 30 days for air). Logistics firms have also warned that last-mile delivery times in lower-tier cities could double during the peak week.

The unusually strong demand is viewed by economists as an early sign of consumer-confidence recovery, with analysts at CICC estimating holiday spending on transport, hotels and attractions could inject RMB 120 billion (US $16.7 billion) of incremental consumption into the domestic economy. If realised, that would provide a welcome boost to service-sector growth as China enters the first year of its 15th Five-Year Plan.