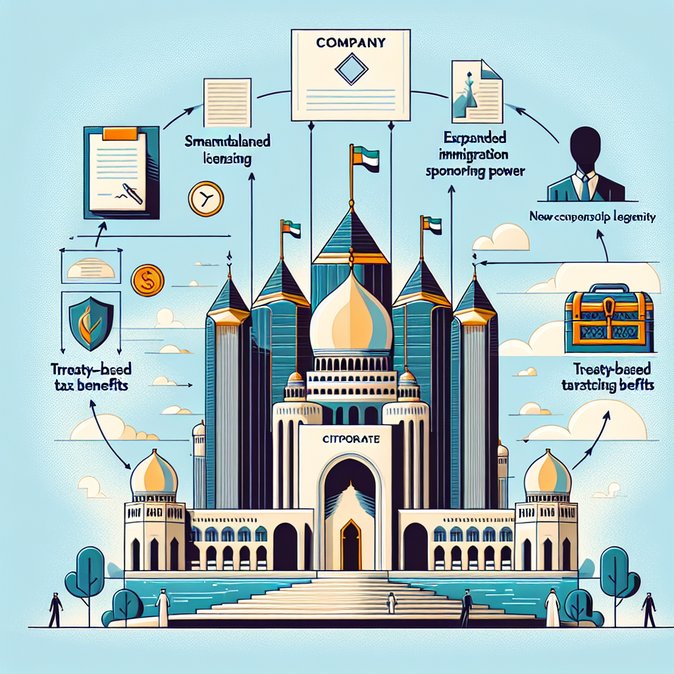

The United Arab Emirates has taken another bold step in its race to be the world’s pre-eminent headquarters location by passing the **Corporate Citizenship Law 2026**, an amendment to the Commercial Companies Law that formally grants registered companies a form of “citizenship” status. In practical terms, the statute does not naturalise shareholders, but it does confer a set of rights and obligations that place qualifying entities on the same legal footing as Emirati-incorporated firms, including priority access to government procurement, simplified licensing renewals and participation in certain federal incentive schemes.(timesofindia.indiatimes.com)

Background discussions with the Ministry of Economy reveal that policymakers want to remove the lingering perception that free-zone or foreign-owned LLCs are “guests” in the market. The new framework allows wholly or majority-foreign-owned firms to apply for corporate citizenship after three consecutive years of audited operations, an Emiratisation compliance rating of at least 2 %, and evidence of “substantive economic presence” such as R&D spend or regional management functions.

For mobility managers this change matters because many assignees’ immigration privileges—Golden Visas, dependent sponsorship and fast-track labour cards—are linked to the status of their sponsoring entity. Companies that secure citizenship will enjoy a unified sponsor code valid across all emirates, greatly reducing paperwork when rotating staff between Dubai, Abu Dhabi and the Northern Emirates. In addition, naturalised entities may issue five-year mission visas directly without using an outsourced PRO.

![UAE Enacts “Corporate Citizenship Law 2026” to Deepen Roots for Multinationals]()

For organisations keen to capitalise on these streamlined immigration rules, VisaHQ can provide end-to-end support. Through its dedicated UAE portal (https://www.visahq.com/united-arab-emirates/), the firm helps businesses and their employees secure Golden Visas, mission visas and document legalisations, and will be updating its services to cover applications that rely on the new corporate-citizenship sponsor code. Using VisaHQ’s online dashboards and concierge assistance, mobility teams can manage filings across all seven emirates while keeping real-time visibility of compliance deadlines.

Tax advisers note that corporate citizens will be eligible for the UAE’s growing double-tax treaty network, which can reduce withholding taxes on outbound profit repatriation. However, they must also file country-by-country reports and meet the new 9 % federal corporate tax obligations due in June 2026. Firms should therefore weigh the compliance cost against the strategic benefit of deeper market integration.

Large multinationals in technology, life-sciences and logistics have already signalled intent to apply, and free-zones such as DIFC and ADGM are offering legal-support packages to help tenants navigate the new regime. The first citizenship certificates are expected to be issued by the start of Q3 2026, giving global companies a fresh incentive to base regional HQ functions—and the accompanying talent—inside the UAE.

Background discussions with the Ministry of Economy reveal that policymakers want to remove the lingering perception that free-zone or foreign-owned LLCs are “guests” in the market. The new framework allows wholly or majority-foreign-owned firms to apply for corporate citizenship after three consecutive years of audited operations, an Emiratisation compliance rating of at least 2 %, and evidence of “substantive economic presence” such as R&D spend or regional management functions.

For mobility managers this change matters because many assignees’ immigration privileges—Golden Visas, dependent sponsorship and fast-track labour cards—are linked to the status of their sponsoring entity. Companies that secure citizenship will enjoy a unified sponsor code valid across all emirates, greatly reducing paperwork when rotating staff between Dubai, Abu Dhabi and the Northern Emirates. In addition, naturalised entities may issue five-year mission visas directly without using an outsourced PRO.

For organisations keen to capitalise on these streamlined immigration rules, VisaHQ can provide end-to-end support. Through its dedicated UAE portal (https://www.visahq.com/united-arab-emirates/), the firm helps businesses and their employees secure Golden Visas, mission visas and document legalisations, and will be updating its services to cover applications that rely on the new corporate-citizenship sponsor code. Using VisaHQ’s online dashboards and concierge assistance, mobility teams can manage filings across all seven emirates while keeping real-time visibility of compliance deadlines.

Tax advisers note that corporate citizens will be eligible for the UAE’s growing double-tax treaty network, which can reduce withholding taxes on outbound profit repatriation. However, they must also file country-by-country reports and meet the new 9 % federal corporate tax obligations due in June 2026. Firms should therefore weigh the compliance cost against the strategic benefit of deeper market integration.

Large multinationals in technology, life-sciences and logistics have already signalled intent to apply, and free-zones such as DIFC and ADGM are offering legal-support packages to help tenants navigate the new regime. The first citizenship certificates are expected to be issued by the start of Q3 2026, giving global companies a fresh incentive to base regional HQ functions—and the accompanying talent—inside the UAE.