Taoiseach Micheál Martin confirmed on 24 November that forthcoming immigration reforms will require citizenship applicants to show they have not received specified social-welfare payments in the two years before applying. Speaking on the sidelines of the G20 summit, Martin said the aim is to ensure Ireland is “not an outlier” compared with other EU countries and the UK.

The reforms—drafted by Justice Minister Jim O’Callaghan—will also extend the residency period for refugees seeking citizenship from three to five years, tighten rules on outstanding State debts, and narrow family-reunification rights to spouses, children and dependent parents. Final legislation is expected before year-end, with detailed guidance to follow after Cabinet discussion this Wednesday.

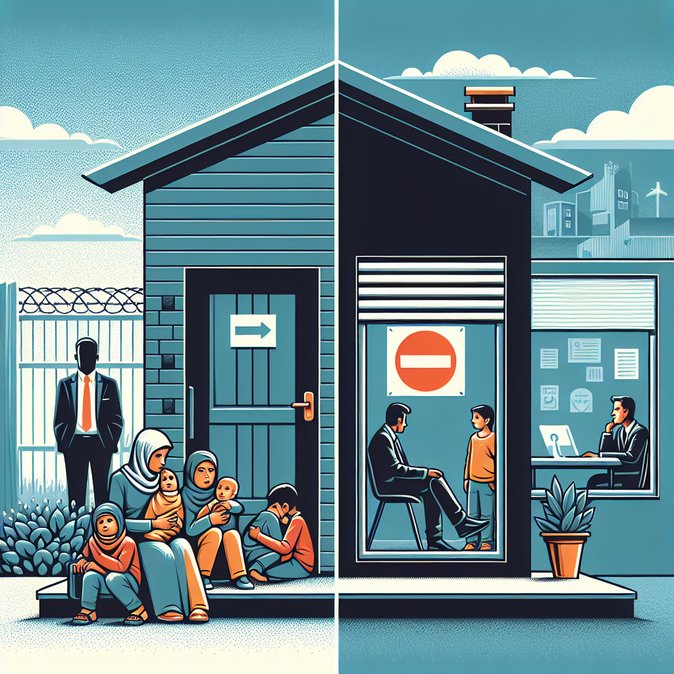

![Citizenship overhaul: Welfare-payment history to be checked under new Irish migration reforms]()

Opposition parties Sinn Féin and Aontú argue the measures risk creating undue hardship for vulnerable migrants, while business groups are anxious for clarity on how social-insurance contributions, maternity benefits and pandemic-related payments will be treated. Employers sponsoring naturalisation for key executives may need to audit payroll records to confirm no disqualifying benefits were claimed.

Practically, the change could lengthen citizenship planning cycles for multinational staff on local contracts and affect relocation packages that include parental-leave top-ups. Immigration advisers recommend starting citizenship eligibility assessments earlier and budgeting for possible appeals once the final list of “in-scope” payments is published.

For Ireland’s global-mobility ecosystem, the proposal reflects a broader European trend toward linking welfare use with migration status. Companies should brief assignees on potential risks and encourage proactive tax-clearance and debt-settlement checks before filing naturalisation applications.

The reforms—drafted by Justice Minister Jim O’Callaghan—will also extend the residency period for refugees seeking citizenship from three to five years, tighten rules on outstanding State debts, and narrow family-reunification rights to spouses, children and dependent parents. Final legislation is expected before year-end, with detailed guidance to follow after Cabinet discussion this Wednesday.

Opposition parties Sinn Féin and Aontú argue the measures risk creating undue hardship for vulnerable migrants, while business groups are anxious for clarity on how social-insurance contributions, maternity benefits and pandemic-related payments will be treated. Employers sponsoring naturalisation for key executives may need to audit payroll records to confirm no disqualifying benefits were claimed.

Practically, the change could lengthen citizenship planning cycles for multinational staff on local contracts and affect relocation packages that include parental-leave top-ups. Immigration advisers recommend starting citizenship eligibility assessments earlier and budgeting for possible appeals once the final list of “in-scope” payments is published.

For Ireland’s global-mobility ecosystem, the proposal reflects a broader European trend toward linking welfare use with migration status. Companies should brief assignees on potential risks and encourage proactive tax-clearance and debt-settlement checks before filing naturalisation applications.