Spain’s airport operator Aena issued an unusual public statement on 5 November after the Senate, at the behest of the Partido Popular (PP), inserted last-minute amendments into the Sustainable Mobility Law. The amendments would freeze airport charges between 2027 and 2031 and force new incentives for under-used regional airports.

Aena argues the cap would blow a hole in the financing of its 2027-2031 investment roadmap—almost €10 billion earmarked for expanding terminals, adding biometric EES infrastructure and upgrading security at 48 airports. The company says it would be "incompatible" with cost-recovery rules established in Law 18/2014 and could compel a complete re-sequencing of works at hubs such as Madrid-Barajas and Barcelona-El Prat just as passenger volumes hit record highs (up 28 % on domestic and 9 % on international tickets since 2022).

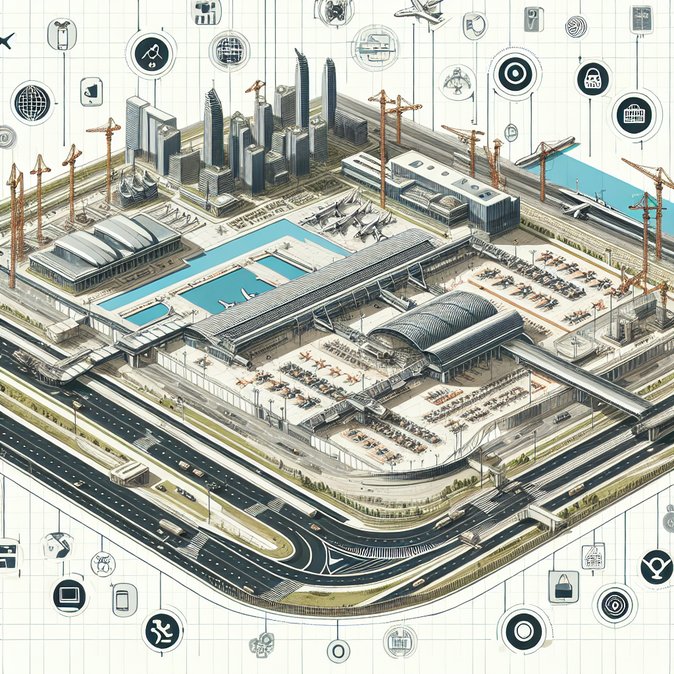

![Aena warns Senate amendments threaten €10 billion airport-upgrade plan and traveller experience]()

Why it matters for global mobility: Spain’s aviation network underpins corporate travel and high-value tourism. Delays or cancellations in runway and terminal projects could strain capacity during peak seasons, extend connection times and slow the deployment of contactless border-control lanes critical for the EU Entry/Exit System. Business-travel managers should monitor the legislative ping-pong as the bill returns to Congress; contingency planning for summer 2027 capacity crunches may be prudent.

From a policy angle, the dispute highlights tension between cost-of-living politics and infrastructure-funding models that rely on user fees. The Transport Ministry has so far sided with Aena, indicating it will seek to overturn the amendments. Investors are likewise watching: Aena’s CNMV filing warned of "legal uncertainty" that could affect dividend policy.

If Congress restores the original text, Aena says procurement for the next-gen security lanes and EES kiosks can proceed in early 2026, keeping Spain on track to meet EU border-digitalisation deadlines.

Aena argues the cap would blow a hole in the financing of its 2027-2031 investment roadmap—almost €10 billion earmarked for expanding terminals, adding biometric EES infrastructure and upgrading security at 48 airports. The company says it would be "incompatible" with cost-recovery rules established in Law 18/2014 and could compel a complete re-sequencing of works at hubs such as Madrid-Barajas and Barcelona-El Prat just as passenger volumes hit record highs (up 28 % on domestic and 9 % on international tickets since 2022).

Why it matters for global mobility: Spain’s aviation network underpins corporate travel and high-value tourism. Delays or cancellations in runway and terminal projects could strain capacity during peak seasons, extend connection times and slow the deployment of contactless border-control lanes critical for the EU Entry/Exit System. Business-travel managers should monitor the legislative ping-pong as the bill returns to Congress; contingency planning for summer 2027 capacity crunches may be prudent.

From a policy angle, the dispute highlights tension between cost-of-living politics and infrastructure-funding models that rely on user fees. The Transport Ministry has so far sided with Aena, indicating it will seek to overturn the amendments. Investors are likewise watching: Aena’s CNMV filing warned of "legal uncertainty" that could affect dividend policy.

If Congress restores the original text, Aena says procurement for the next-gen security lanes and EES kiosks can proceed in early 2026, keeping Spain on track to meet EU border-digitalisation deadlines.