Uruguay customs

Need help?Chat with us

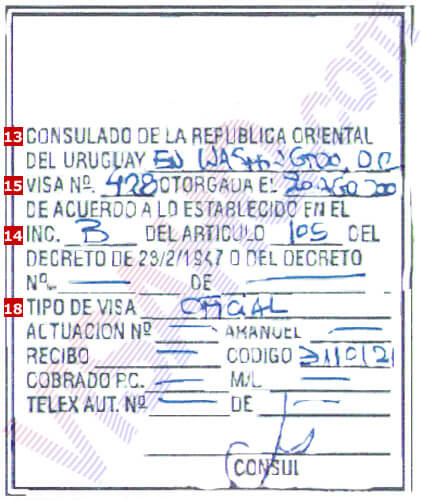

Apply for visa

Free import

• 400 cigarettes or 50 cigars or 500g of tobacco for over 18 years old

• 2L alcohol for over 18 years old

• Non-commercial amount of gifts and other items for personal use. The allowance is distributed as follows:

- Entrance by land - goods worth up to US$ 150 or equivalent (once a month)

- By air or sea, US$ 300 for travellers from Argentina, Bolivia, Brazil, Chile and Paraguay (once a month). For travellers from other countries the allowance is up to US$ 500 or equivalent (once a year)

- Passengers under 18 years old are allowed 50% corresponding allowance

• Sporting goods and musical instruments – used and for personal use

• Electrical equipment for personal use (see Restricted Items for mobile regulations)

Prohibited

• Narcotics

• Alkaloids

• Pornography

• Subversive material

• Counterfeit items

• Cultural artefacts and other objects of cultural importance

• Explosive and flammable material

• Plants and any parts or products thereof

• Fruits and vegetables

• Soil, seeds (items with vegetables and seeds i.e. bracelets etc.)and flowers and parts thereof

• Animal feed and other veterinary related products (biological or chemical)

• Trees any parts or products thereof

• Fresh dairy products like cream, milk etc. (excepts long life milk)

• Birds

• Bees and honey

• Meat of any kind

Restricted

• Live animals – health certificate required along with complete and valid inoculations.

• Endangered species and any products or parts thereof as outlined by CITES maybe be brought in only with CITES permission.

• Medication – accompanied by prescription, in original container and with original label. The quantity should not be greater than what is need for the length of your stay in the country.

• Currency – amount exceeding equivalent of US$ 10,000 must be declared. It includes negotiable instruments, jewellery, precious metals etc.

• Mobile telephones need to be declared, and tax needs to be paid if one is planning to change to Uruguayan telephone provider.

• 400 cigarettes or 50 cigars or 500g of tobacco for over 18 years old

• 2L alcohol for over 18 years old

• Non-commercial amount of gifts and other items for personal use. The allowance is distributed as follows:

- Entrance by land - goods worth up to US$ 150 or equivalent (once a month)

- By air or sea, US$ 300 for travellers from Argentina, Bolivia, Brazil, Chile and Paraguay (once a month). For travellers from other countries the allowance is up to US$ 500 or equivalent (once a year)

- Passengers under 18 years old are allowed 50% corresponding allowance

• Sporting goods and musical instruments – used and for personal use

• Electrical equipment for personal use (see Restricted Items for mobile regulations)

Prohibited

• Narcotics

• Alkaloids

• Pornography

• Subversive material

• Counterfeit items

• Cultural artefacts and other objects of cultural importance

• Explosive and flammable material

• Plants and any parts or products thereof

• Fruits and vegetables

• Soil, seeds (items with vegetables and seeds i.e. bracelets etc.)and flowers and parts thereof

• Animal feed and other veterinary related products (biological or chemical)

• Trees any parts or products thereof

• Fresh dairy products like cream, milk etc. (excepts long life milk)

• Birds

• Bees and honey

• Meat of any kind

Restricted

• Live animals – health certificate required along with complete and valid inoculations.

• Endangered species and any products or parts thereof as outlined by CITES maybe be brought in only with CITES permission.

• Medication – accompanied by prescription, in original container and with original label. The quantity should not be greater than what is need for the length of your stay in the country.

• Currency – amount exceeding equivalent of US$ 10,000 must be declared. It includes negotiable instruments, jewellery, precious metals etc.

• Mobile telephones need to be declared, and tax needs to be paid if one is planning to change to Uruguayan telephone provider.