Statistics Finland’s latest maritime passenger report, released on 8 November 2025, offers a mixed picture for companies that rely on sea links to move people and goods to and from Finland. Overall passenger volumes on scheduled ferry routes slipped by one per cent year-on-year in September, totalling just over one million travellers.

The Helsinki–Tallinn shuttle service—long the busiest corridor for both leisure and business travellers—retained its dominance with 538,201 passengers, while the Finland–Sweden routes carried 406,377 people. Long-distance services to Germany accounted for a more modest 13,035 passengers.

![Cruise traffic slows, but foreign cruise ship visits surge in Finland]()

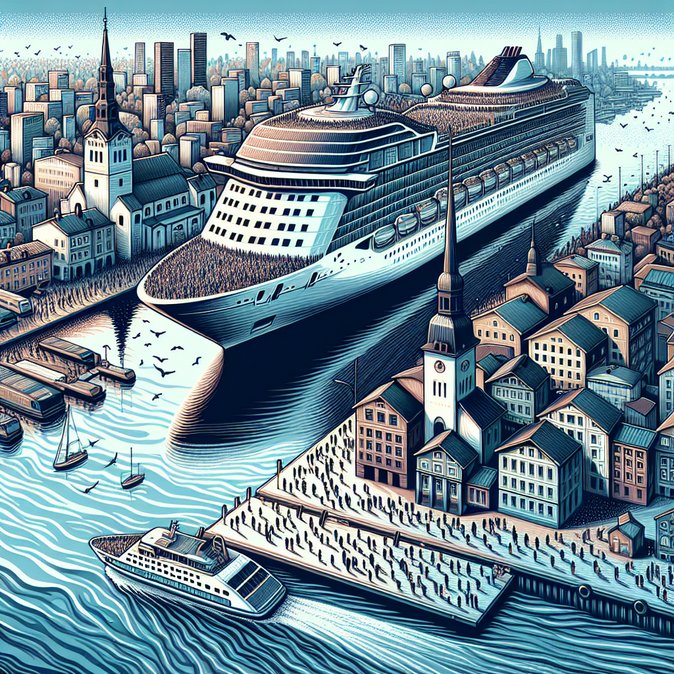

Behind the headline dip, however, lies a notable bright spot for Finland’s visitor economy: the number of passengers arriving on international cruise vessels jumped 34 per cent to 32,073 compared with September 2024. Port operators in Helsinki, Turku and Mariehamn attribute the rise to cruise lines repositioning Baltic itineraries to avoid Black Sea and eastern Mediterranean tensions, as well as the growing popularity of autumn “Northern Lights” cruises that call at Finnish ports before heading north to Tromsø and Alta.

The contrasting trends carry practical implications for global mobility managers and travel suppliers. Corporations that rotate project teams between Helsinki and Stockholm or Tallinn will face slightly reduced service frequency this winter as ferry operators trim capacity to match softer demand, potentially lengthening journey times or increasing reliance on air links. On the upside, the surge in cruise arrivals signals renewed appetite among international passengers to enter Finland by sea, easing concerns that geopolitical uncertainty might depress inbound tourism.

Port authorities say they will use the updated data to fine-tune terminal staffing plans and to accelerate the rollout of the EU’s new Entry/Exit System (EES) kiosks ahead of the October 2025 launch. Cruise lines, meanwhile, are lobbying for streamlined visa-on-arrival procedures for third-country nationals disembarking for short shore excursions—a move Finnish tourism bodies support, arguing it would turn day-trippers into repeat visitors. Travel buyers should monitor potential timetable changes on the core Sweden and Estonia routes and be prepared to advise employees on alternative modes if sailing frequencies are reduced further over the winter.

The Helsinki–Tallinn shuttle service—long the busiest corridor for both leisure and business travellers—retained its dominance with 538,201 passengers, while the Finland–Sweden routes carried 406,377 people. Long-distance services to Germany accounted for a more modest 13,035 passengers.

Behind the headline dip, however, lies a notable bright spot for Finland’s visitor economy: the number of passengers arriving on international cruise vessels jumped 34 per cent to 32,073 compared with September 2024. Port operators in Helsinki, Turku and Mariehamn attribute the rise to cruise lines repositioning Baltic itineraries to avoid Black Sea and eastern Mediterranean tensions, as well as the growing popularity of autumn “Northern Lights” cruises that call at Finnish ports before heading north to Tromsø and Alta.

The contrasting trends carry practical implications for global mobility managers and travel suppliers. Corporations that rotate project teams between Helsinki and Stockholm or Tallinn will face slightly reduced service frequency this winter as ferry operators trim capacity to match softer demand, potentially lengthening journey times or increasing reliance on air links. On the upside, the surge in cruise arrivals signals renewed appetite among international passengers to enter Finland by sea, easing concerns that geopolitical uncertainty might depress inbound tourism.

Port authorities say they will use the updated data to fine-tune terminal staffing plans and to accelerate the rollout of the EU’s new Entry/Exit System (EES) kiosks ahead of the October 2025 launch. Cruise lines, meanwhile, are lobbying for streamlined visa-on-arrival procedures for third-country nationals disembarking for short shore excursions—a move Finnish tourism bodies support, arguing it would turn day-trippers into repeat visitors. Travel buyers should monitor potential timetable changes on the core Sweden and Estonia routes and be prepared to advise employees on alternative modes if sailing frequencies are reduced further over the winter.

More From Finland

View all

EU Ends Multiple-Entry Schengen Visas for Russians—Finland Braces for Surge in Single-Trip Applications

First Post-Launch Review of EU Entry/Exit System Highlights Smooth Roll-Out at Finnish Borders