The Ministry of Economy used a 2 November 2025 circular to clarify details of the draft 2026 budget’s headline measure: raising the forfait tax for high-net-worth individuals (HNWIs) relocating to Italy from €200,000 to €300,000 per year. The increase, effective 1 January 2026 once the budget is approved, aims to generate additional revenue without scrapping the scheme that has attracted more than 1,200 foreign taxpayers since 2017.

Officials emphasised that existing beneficiaries will enjoy a two-year grandfathering period at the current €200,000 rate, provided they maintain tax residency and meet the programme’s investment thresholds. New applicants from 2026 will pay the higher amount, but the government will streamline filing by introducing a one-page pre-filled declaration and extending withholding-tax exemptions to qualifying family members.

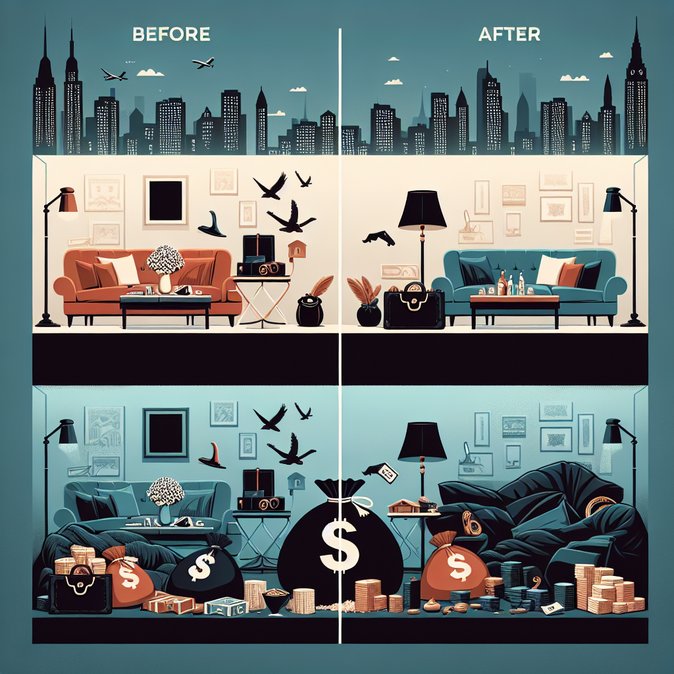

![Italy Confirms 50 % Hike to Flat Tax for Wealthy New Residents in 2026 Budget Bill]()

Private-client advisers say interest remains strong among UK, Swiss and US executives seeking a Mediterranean base post-Brexit, but the higher cost may shift demand toward Portugal’s Non-Habitual Resident (NHR) scheme or Greece’s lump-sum tax. Real-estate brokers in Milan and Florence expect a short-term surge of applications before year-end as HNWIs rush to lock in the lower rate.

For multinational employers, the clarified rules are essential when structuring assignment packages: companies must decide whether to gross-up the flat-tax payment or leave executives to bear the additional €100,000. HR should also revisit shadow-payroll processes, as the circular confirms that the forfait tax remains a personal liability not subject to employer reporting under Italian payroll law.

Officials emphasised that existing beneficiaries will enjoy a two-year grandfathering period at the current €200,000 rate, provided they maintain tax residency and meet the programme’s investment thresholds. New applicants from 2026 will pay the higher amount, but the government will streamline filing by introducing a one-page pre-filled declaration and extending withholding-tax exemptions to qualifying family members.

Private-client advisers say interest remains strong among UK, Swiss and US executives seeking a Mediterranean base post-Brexit, but the higher cost may shift demand toward Portugal’s Non-Habitual Resident (NHR) scheme or Greece’s lump-sum tax. Real-estate brokers in Milan and Florence expect a short-term surge of applications before year-end as HNWIs rush to lock in the lower rate.

For multinational employers, the clarified rules are essential when structuring assignment packages: companies must decide whether to gross-up the flat-tax payment or leave executives to bear the additional €100,000. HR should also revisit shadow-payroll processes, as the circular confirms that the forfait tax remains a personal liability not subject to employer reporting under Italian payroll law.